Why Investment Crowdfunding Sites Ask So Many Personal Questions

Crowdfunding sites are designed to feel a lot more like online shopping than a bank, but they’re still beholden to a range of bank-style requirements for collecting customer data

One of the reasons investment crowdfunding is successful is that it makes investing feel kinda like online shopping.

But it won’t take long before you’re asked to reveal quite a bit more than you’re used to when shopping for clothes or furniture. Things like your social security number, your income, and even your bank account number—exactly the kinds of things we’ve been conditioned to (rightfully!) be very wary about giving out online.

Depending on the investment platforms, here’s some of the things you might be asked for when investing (and in some cases before you’re even able to see any of the available investments):

- Your full name

- Your home address

- Your birth date

- Your social security number

- Your net worth

- Your annual income

- Your bank account number

So why the rush to get all this sensitive info from you? In most cases, it all comes down to rules and regulations used to prevent money laundering. (Often referred to as “AML” for “Anti-money laundering” and “KYC” for “Know Your Customer”).

It’s not really anything new, but what’s different is that most of us only rarely fill out formal financial paperwork (like for a bank, a brokerage account, or maybe a 401K), and when we do it’s still often on paper where we’re already used to divulging that kind of information. These new investment sites are designed to feel a lot more like online shopping and a lot less like a bank, but when it comes to those AML and KYC rules, they’re still beholden to those bank-style requirements.

(There’s an added wrinkle that some platforms, in particular those that are broker-dealers, are also obligated to ensure an investment is “suitable” for a customer, which means knowing some fairly specific things about that customer, including net worth, income, risk tolerance, and investment goals.)

And to top it off, for some kinds of investments open only to accredited investors (in particular, those offered under Rule 506(c) of Reg D), the platforms are obligated to take “reasonable steps” to explicitly confirm a customer’s accreditation status — and to reconfirm every 90 days! Whether they do it themselves or use a 3rd party, investors may repeatedly end up supplying something like W2s, tax returns, bank statements, or a letter from a CPA or attorney.

The reality is that if you want to participate in online alternative investing and equity crowdfunding, you’ll eventually need to share some fairly detailed information with the investment platform. You should of course exercise your own best judgment, and only do business with a platform you’re comfortable has policies and procedures in place to keep your information secure. There’s also a few other steps you might consider taking to improve the odds your personal information stays personal:

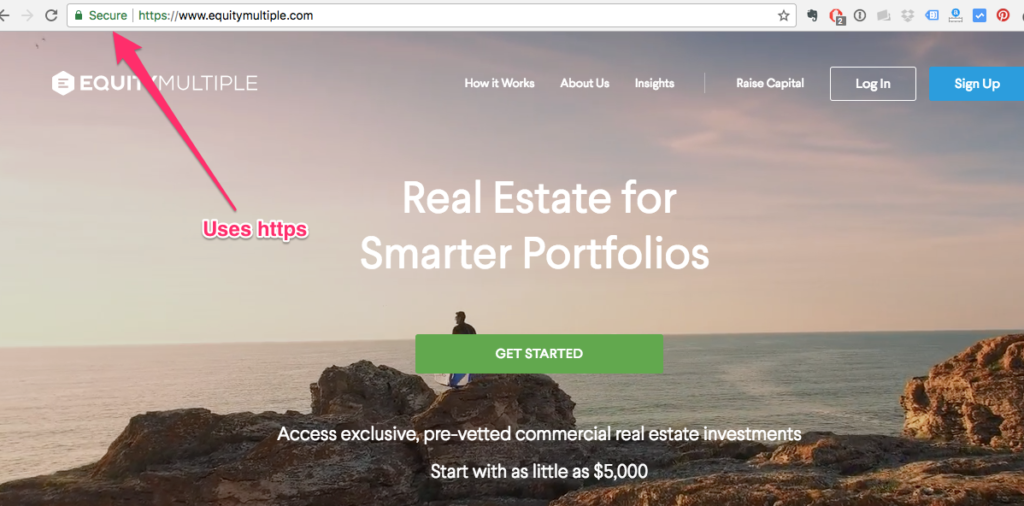

Confirm the site uses a secure connection

To do this, just look in the address bar of your browser. There’s simply no excuse for a website not to use https these days, especially a financial services website. Compare the two screenshots below to see how to tell the difference (this is using Google Chrome, but other browsers have similar indicators).

Don’t use the same password for multiple sites

As frustrating as it was to recently read that the man behind all those frustrating password requirements we’ve been living with for more than a decade now says he was wrong, it’s still important not to use the same password for multiple sites. Fortunately, there’s now built-in password generators and managers in most major browsers, as well as great 3rd-party apps like 1Password (which I use and love), and LastPass.

Consider using a separate checking account just for transferring money in and out of investment platforms

For an extra layer of comfort, you might consider opening up a separate free checking account just to use as a holding pen for transfers to investment platforms. As a side benefit, it’ll also help cordon off any dividends or distributions, some of which may arrive without you noticing if they just get deposited into your “regular” checking account.

Want to learn more but aren’t sure where to start? You can explore 168 crowdfunding investment platforms in our database and learn more about the nuts and bolts of crowdfunding and alternative investing on our blog. Did you know you can use a self-directed retirement account to invest in many alternative investments? Rocket Dollar makes it easy, and when you sign up using that link you'll be helping to support YieldTalk.

Share this post: