Are Crowdfunding Sites Safe Places to Invest?

Mergers, consolidation, “pivots”, restructuring, lawsuits, and even bankruptcies — there will no doubt be more of all of these within the investment crowdfunding ecosystem, so know what that means for you as an investor

Investment crowdfunding sites are the new kids on the block when it comes to online investing, and understandably there’s a lot of folks wondering whether investment crowdfunding sites are safe places to invest money.

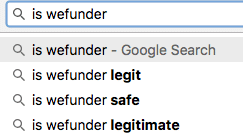

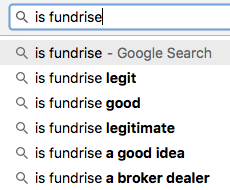

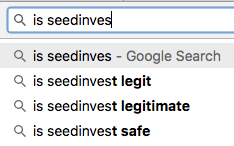

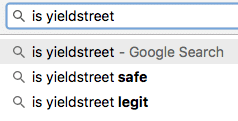

For example, take a look at some of Google’s suggestions for searches about YieldStreet, Seedinvest, Fundrise, and Wefunder:

The topic of whether crowdfunding sites are safe or legit comes up a lot on popular Q&A sites too. For example, here’s a recent thread I weighed in on at Quora:

And a similar line of questions from the Personal Finance section of Stack Exchange:

So are investment crowdfunding sites safe places to invest?

Well, it depends a bit what you mean by “safe”.

Are crowdfunding sites safe places to invest the way an FDIC-insured investment is safe? Nope. You could certainly lose some or all of your investment if something goes wrong: if the borrower defaults on a loan; if the company you backed goes bust; or even if the platform itself ends up in legal hot water or even bankruptcy, you may be at best left in a long line of creditors looking for scraps.

Are crowdfunding sites safe places to invest in the sense of being legitimate businesses and investment options? Maybe.

In part, that’s because even though borrower defaults and startup-investment failures are to be expected with these kind of investments, major issues with the investment crowdfunding sites themselves do also happen from time to time. For example:

- Early real estate investment crowdfunding site iFunding is currently insolvent and going through a restructuring, and investors are facing some unpleasant options.

- Litigation finance site TrialFunder’s website stopped working several weeks ago, and there’s no indication it’s coming back up.

- SoCal-based real estate investment crowdfunding site DiversyFund has a pending action against it by the California Bureau of Real Estate (h/t to Ian Ippolito for spotting that)

- Rich Uncles is under review by the SEC (to be clear, not under investigation) regarding some of their practices. No indication there’s been any wrongdoing, but undoubtedly a distraction for any startup

- Fundrise at one point had to fire their CFO, citing an extortion attempt

It’s also important for prospective investors in crowdfunding sites to know that delays are quite common with alternative assets (especially real estate). Platforms often advertise their returns and/or tout that they haven’t had any defaults, but that doesn’t mean there haven’t been seriously late payments or other times when investments performed very differently than expected.

And even if nothing “bad” happens, sometimes early-stage companies in fast-moving industries like investment crowdfunding “pivot”, merge, or otherwise change course and so look quite a bit different from when you first look at them:

- Real estate investment crowdfunding site Acquire Real Estate was bought by RealtyShares, who in turn just sold off their residential origination business to Lima Capital

- Startup funding site DreamFunded has switched from startups to real estate financing

(Of course publicly traded companies are not immune to nasty surprises — just ask shareholders of Wells Fargo stock.)

Mergers, consolidation, “pivots”, restructuring, lawsuits, and even bankruptcies — there will no doubt be more of all of these within the investment crowdfunding ecosystem, and it’s important to keep in mind that is one of the big reasons you as an investor can (and should) expect a higher return to compensate for that kind of uncertainty.

Be sure to carefully review any investment crowdfunding site before committing your money to an investment offering. In the same way that looking at startup investments should involve some careful research into things like social media accounts and public database profiles, those same techniques can also be used to evaluate the platforms themselves — after all you’re “hiring” them to help you look after your money in one way or another, and it only makes sense to interview them for the job:

- What happens to your investment if the company goes under?

- How well funded are they? (And even if they’ve received a lot of funding, there’s always the risk that just means their expenses are so high that it’ll be very difficult to absorb a slowdown in business.)

- When were they founded?

- Do they have a credible, consistent, and professional presence on sites like LinkedIn and Twitter?

-

How many investments have they seen through from start to finish?

(Pssst!: Fortunately we can help give you a head start on that kind of research via our database of crowdfunding investment website reviews and profiles!) A few other sites offering useful insight into the investment crowdfunding ecosytem include CrowdWise, FundWisdom, KingsCrowd, and The Real Estate Crowdfunding Review.

There is no such thing as a truly “safe” investment. And like any nascent financial ecosystem, that of investment crowdfunding sites will no doubt see its share of frauds and failures. That’s all the more reason to be selective about where you invest your money, diversify your investments across multiple sites, and start small while you’re learning.

Want to learn more but aren’t sure where to start? You can explore 168 crowdfunding investment platforms in our database and learn more about the nuts and bolts of crowdfunding and alternative investing on our blog. Did you know you can use a self-directed retirement account to invest in many alternative investments? Rocket Dollar makes it easy, and when you sign up using that link you'll be helping to support YieldTalk.

Share this post: